The following information relates to Questions

betty tatton is a fixed income analyst with the hedge fund Sailboat asset Management (SaM) .SaM invests in a variety of global fixed-income strategies, including fixed-income arbitrage.tatton is responsible for pricing individual investments and analyzing market data to assess the opportunity for arbitrage. She uses two methods to value bonds:

Method 1: Discount each year's cash flow separately using the appropriate interest rate curve.

Method 2: build and use a binomial interest rate tree.

tatton compiles pricing data for a list of annual pay bonds (exhibit 1) . each of the bonds will mature in two years, and tatton considers the bonds as being risk-free; both the one-year and two-year benchmark spot rates are 2%. tatton calculates the arbitrage-free prices and identifies an arbitrage opportunity to recommend to her team.exhibit 1 Market Data for Selected bonds

next, tatton uses the benchmark yield curve provided in exhibit 2 to consider arbitrage opportunities of both option-free corporate bonds and corporate bonds with embedded op-tions. The benchmark bonds in exhibit 2 pay coupons annually, and the bonds are priced at par.exhibit 2 benchmark Par Curve

tatton then identifies three mispriced three-year annual-pay bonds and compiles data onthe bonds (see exhibit 3) .

exhibit 3 Market Data of annual-Pay Corporate bonds

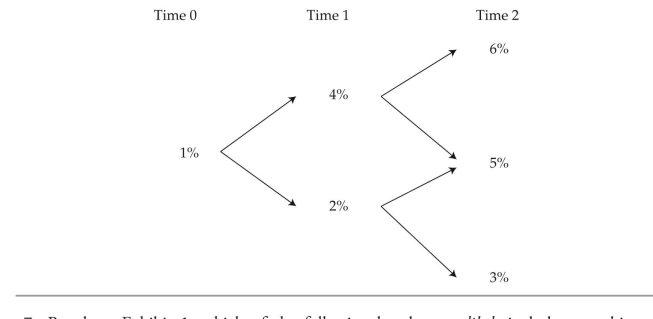

last, tatton identifies two mispriced Swiss bonds, ond x, a three-year bond, and bond Y, a five-year bond. both are annual-pay bonds with a coupon rate of 6%. to calculate the bonds' values, tatton devises the first three years of the interest rate lognormal tree presented in exhibit 4 using historical interest rate volatility data. tatton considers how these data would change if implied volatility, which is higher than historical volatility, were used instead.

exhibit 4 interest rate tree; Forward rates based on Swiss Market

-based on exhibit 4 and using Method 2, the correct price for bond x is closest to:

A) 97.2998.

B) 109.0085.

C) 115.0085.

Correct Answer:

Verified

Q7: The following information relates to Questions

Q8: The following information relates to Questions

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions

Q12: The following information relates to Questions

Q14: The following information relates to Questions

Q15: The following information relates to Questions

Q16: The following information relates to Questions

Q17: The following information relates to Questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents