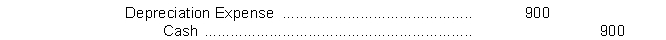

A new accountant working for Spirit Walker Company records $900 Depreciation Expense on store equipment as follows:  The effect of this entry is to

The effect of this entry is to

A) adjust the accounts to their proper amounts on December 31.

B) understate total assets on the balance sheet as of December 31.

C) overstate the book value of the depreciable assets at December 31.

D) understate the book value of the depreciable assets as of December 31.

Correct Answer:

Verified

Q67: Accrued revenues are revenues that have been

Q68: In general, adjusting entries are required each

Q69: Which of the following is in accordance

Q70: Crue Company had the following transactions

Q71: A liability-revenue relationship exists with

A)prepaid expense adjusting

Q73: Double Nickels Company purchased equipment for $9,000

Q74: Sebastian Belle has performed $2,000 of CPA

Q75: Alternative adjusting entries do not apply to

A)accrued

Q76: The time period assumption states that the

Q77: Which of the following statements related to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents