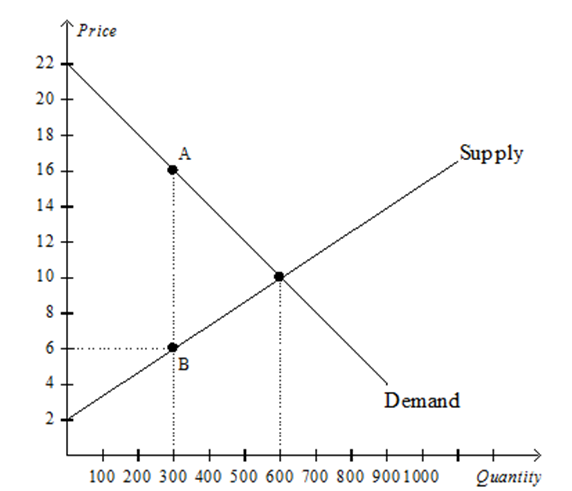

Suppose the government levies a tax of the vertical distance from point A to point B. Using the graph shown below, determine the value of each of the following:

a. equilibrium price before the tax

b. consumer surplus before the tax

c. producer surplus before the tax

d. total surplus before the tax

e. consumer surplus after the tax

f. producer surplus after the tax

g. total tax revenue to the government

h. total surplus (consumer surplus + producer surplus + tax revenue) after the tax

i. deadweight loss

Correct Answer:

Verified

b. R3 600

c. ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: In general, a tax raises the price

Q21: Marginal tax is

A) the taxes paid by

Q22: An efficient tax

A) minimises the administrative burden

Q24: The average tax rate is

A) total taxes

Q25: An individual's tax total tax payments divided

Q27: Which of the following taxes can be

Q29: An individual's marginal tax rate equals

A) total

Q30: The appropriate tax rate to consider to

Q36: A tax is _ if it takes

Q38: A progressive tax system is one where

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents