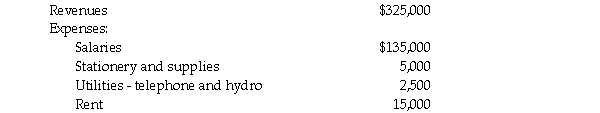

You are performing a review of a lawyer's books of account. The lawyer's office is in Ontario where the HST rate is 13 percent. While you are in her office, she asks you to calculate how much her HST remittance should be. You are given the following amounts which exclude HST charged or paid.  Based on the above transactions, the HST payable is:

Based on the above transactions, the HST payable is:

A) $21,775.

B) $39,325.

C) $39,975.

D) $41,275.

E) None of the above.

Correct Answer:

Verified

Q41: Which of the following statements related to

Q42: Jasper Appliances is an Ontario HST registrant.

Q43: John Barker owns a repair shop in

Q44: In Ontario, the HST rate is 13

Q45: With respect to the quick method of

Q47: With respect to the simplified method of

Q48: Joel Knight, a lawyer, is a sole

Q49: George Black lives in Manitoba, a non-participating

Q50: Paddy's Cycle Shop operates in Ontario where

Q51: Elfassy Art Dealers is a new business

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents