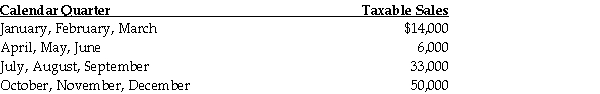

Mr. Marcus Leblanc begins his business on January 1 of the current year. His quarterly sales of taxable items are as follows:  At what point in time will Mr. Leblanc have to begin collecting GST? At what point will he be required to register?

At what point in time will Mr. Leblanc have to begin collecting GST? At what point will he be required to register?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Mr. Jack Morton works in the province

Q73: Sheila Hammer starts a new business on

Q74: Click Cameras, an unincorporated retail business, operates

Q75: In April of the current year, Bryan

Q76: A partnership operates an engineering firm, providing

Q78: During the current taxation period, Mackin Enterprises

Q79: Brad Inc. had sales of merchandise during

Q80: Edleson Inc. is located in a province

Q81: For each of the key terms listed,

Q82: Narston Ltd. operates in Alberta which does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents