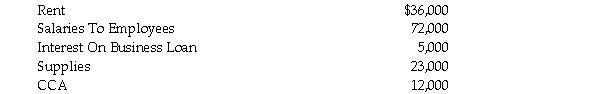

May Poplar lives in Alberta, a province that does not participate in the HST program. During the current year she records service revenue of $326,000. May has never used the ITA 34 option to record revenue on a billed basis. Her current expenses for the year are as follows (all amounts are before GST):  Her inventory of Supplies increased by $4,000 during the year. In addition to these current expenditures, she acquired additional furniture and fixtures in the amount of $18,000, before the inclusion of GST. She files her GST return on an annual basis and does not use the Quick Method.

Her inventory of Supplies increased by $4,000 during the year. In addition to these current expenditures, she acquired additional furniture and fixtures in the amount of $18,000, before the inclusion of GST. She files her GST return on an annual basis and does not use the Quick Method.

Determine the net GST payable or refund for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Felicia's Frocks, an unincorporated retail business, operates

Q67: Which of the following transactions related to

Q68: Marvin Gardens starts a new business on

Q69: Alvin Creek has a business in Nova

Q70: Ms. Jesse Holt begins her business on

Q72: Mr. Jack Morton works in the province

Q73: Sheila Hammer starts a new business on

Q74: Click Cameras, an unincorporated retail business, operates

Q75: In April of the current year, Bryan

Q76: A partnership operates an engineering firm, providing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents