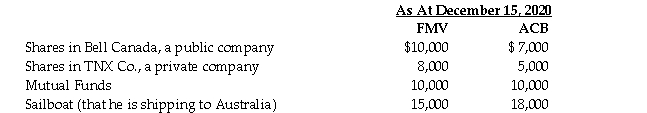

Mr. Winsome is a Canadian citizen and has been resident in Canada for the past 35 years. His company has offered him a position with its Australian branch, which Mr. Winsome has accepted. The position is a transfer and Mr. Winsome plans to remain in Australia for the rest of his life. Given the temperate climate in Australia, he thinks it will be a good country to retire in. Mr. Winsome has the following assets in Canada on December 15, 2020, the date of his departure from Canada:  He sold all of his other assets. Which of the following is correct?

He sold all of his other assets. Which of the following is correct?

A) Mr.Winsome will be deemed to have disposed of his mutual funds, sailboat, TNX Co. shares and Bell Canada shares on December 15, 2020.

B) Mr.Winsome can elect to defer the gain on the Bell Canada shares until they are sold, only if security acceptable to the CRA is provided.

C) Mr. Winsome can elect to have a deemed disposition of the Bell Canada shares on December 15, 2020, only if security acceptable to the CRA is provided.

D) None of the above.

Correct Answer:

Verified

Q36: Under ITA 2(3), gains resulting from the

Q37: When an individual immigrates to Canada, there

Q38: While Canadian dividends paid to U.S. residents

Q39: Under ITA 115(2)certain non-resident individuals will be

Q40: Mike O'Shea, a resident of Ireland, has

Q42: Because of his distaste for Canadian winters,

Q43: In each of the following Cases, determine

Q44: In each of the following Cases, determine

Q45: Certain types of Canadian income earned by

Q46: A non-resident individual owns a rental property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents