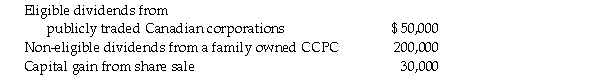

The Weir family trust is an inter vivos trust with one beneficiary. The beneficiary is 25 year old Marcus Weir, the son of the settlor. During 2020, the trust had the following income:  The non-eligible dividends and capital gain are distributed to Marcus. By how much will Marcus' Net Income for Tax Purposes increase as a result of this distribution? Ignore the possibility that the income received by Marcus could be subject to the TOSI.

The non-eligible dividends and capital gain are distributed to Marcus. By how much will Marcus' Net Income for Tax Purposes increase as a result of this distribution? Ignore the possibility that the income received by Marcus could be subject to the TOSI.

A) $245,000.

B) $291,000.

C) $215,000.

D) $265,000.

Correct Answer:

Verified

Q46: An inter vivos trust earned $50,000 in

Q47: Which one of the following statements with

Q48: Anika is planning to create a testamentary

Q49: Which of the following statements is NOT

Q50: On July 1, 2020, Martin Long transfers

Q52: In 2019, Diego transferred property with an

Q53: Which of the following amounts will NOT

Q54: On the death of Martin Meryk, his

Q55: Which of the following statements is correct

Q56: The Strike family trust is an inter

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents