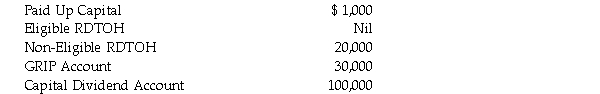

Ku Jung owns all of the shares of Jay Ltd. His adjusted cost base for these shares is $5,000. He has decided to retire, and has wound up the Company under the provisions of ITA 88(2) . After the assets have been sold and all corporate taxes paid, there is $700,000 available for distribution. The balances in the tax accounts of Jay Ltd. are as follows:  If Mr. Jung properly files all elections that would minimize the tax effect of the distribution, what is the maximum amount he could receive tax free?

If Mr. Jung properly files all elections that would minimize the tax effect of the distribution, what is the maximum amount he could receive tax free?

A) $1,000

B) $5,000

C) $100,000

D) $101,000

Correct Answer:

Verified

Q57: With respect to an exchange of shares

Q58: Several conditions are required in order that

Q59: Mamma Mia is the sole shareholder of

Q60: Ms. Takase is the sole shareholder of

Q61: Indicate which of the following features would

Q63: Jasmine Lee owns all of the shares

Q64: With respect to the application of ITA

Q65: Which of the following conditions is NOT

Q66: During the current year, all of the

Q67: Ariella Buxo owns convertible bonds of Lion

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents