On January 1, 2016, Chipper Ltd. acquired 100 percent of the outstanding shares of Intell Inc. at a cost of $1,800,000. At this point in time, the fair market value of Intell's identifiable net assets was $1,275,000, including $405,000 for the Land. The tax values of the net assets at that time totalled $615,000.

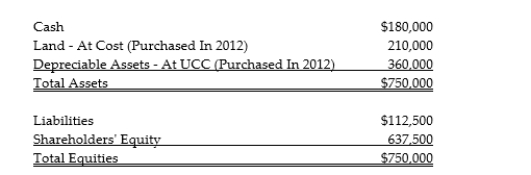

On December 31, 2020, there is a winding-up of Intell Inc. under the provisions of ITA 88(1). Intell Inc. has paid no dividends since its acquisition by Chipper Ltd. On December 31, 2020, the condensed Balance Sheet of Intell Inc. is as follows:  Determine the tax values that will be recorded for Intell Inc.'s assets after they have been incorporated into the records of Chipper Ltd.

Determine the tax values that will be recorded for Intell Inc.'s assets after they have been incorporated into the records of Chipper Ltd.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: Which of the following is one of

Q77: Two unrelated companies, one of which has

Q78: Mr. Germotte has two offers to purchase

Q79: Farnum Ltd. is a Canadian controlled private

Q80: Mr. Morgan Forbes is the sole shareholder

Q82: Sundown Inc. is a Canadian controlled private

Q83: For each of the key terms listed,

Q84: Mr. Jean Doyen owns 80 percent of

Q85: Kelowna Corporation acquires 100 percent of the

Q86: Margaret Hutch owns 60 percent of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents