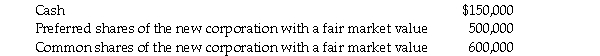

Daniel Kwok transfers his business assets to a corporation and elects a value of $678,000 for the assets transferred. These assets have a fair market value of $1,250,000. Daniel receives the following consideration:  How will the elected value be allocated between: the non-share consideration, the preferred shares issued, and the common stock issued?

How will the elected value be allocated between: the non-share consideration, the preferred shares issued, and the common stock issued?

A) $150,000; $0; $528,000

B) $150,000; $500,000; $28,000

C) $150,000; $528,000; $0

D) $150,000; $264,000; $264,000

Correct Answer:

Verified

Q39: Which of the following would NOT be

Q40: ITA 85(1)can only be used to transfer

Q41: Meng Zheng wishes to transfer a piece

Q43: Jason transferred a piece of land he

Q46: Mr. Fingula transfers property to a corporation

Q47: Noor Ali transfers shares in Ali Manufacturing

Q48: Myron Cohen owns a retail store that

Q49: Ali Manufacturing Inc. owns shares in Ali

Q123: Eric Lehnserr owns 100 percent of Magnus

Q135: Mary Hanson is holding 1,000 shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents