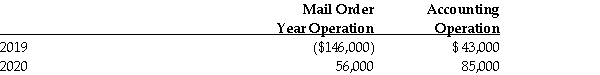

Ambee Ltd. commenced operations in 2019, and has two separate lines of business. They are a mail order operation selling organic food products, and an operation that provides accounting services to small business. The income (loss)of the two operations for the years 2019 and 2020 are as follows:  The Company has no deductions from Net Income For Tax Purposes other than possible loss carry forwards from 2019.

The Company has no deductions from Net Income For Tax Purposes other than possible loss carry forwards from 2019.

Determine the minimum Taxable Income for each of the two years, and any loss carry forward available at the end of the year assuming that there was no acquisition of control in either year. How would your answer be different if there was an acquisition of control on January 1, 2020?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Which of the following transactions will NOT

Q62: Anderson Inc., BDO Ltd., and Copper Inc.,

Q63: During the taxation year ending December 31,

Q64: Mark is the only shareholder of Sico

Q65: Sarah Kern owns 80 percent of the

Q67: Which of the following transactions that involve

Q68: What are the tax consequences associated with

Q69: At the beginning of the current year,

Q70: During the taxation year ending December 31,

Q71: During its taxation year ending December 31,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents