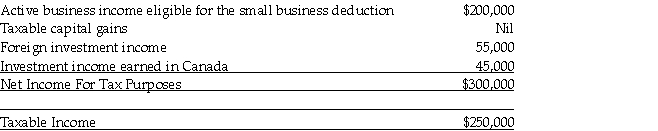

A Ltd. is a Canadian controlled private corporation that operates a chain of fast-food restaurants. In its most recent fiscal year, the Company had the following financial results:  The Company paid no foreign taxes on its foreign investment income. A Ltd. is not associated with any other corporations. Which one of the following amounts represents the refundable portion of Part I tax?

The Company paid no foreign taxes on its foreign investment income. A Ltd. is not associated with any other corporations. Which one of the following amounts represents the refundable portion of Part I tax?

A) $13,800.

B) $15,333.

C) $30,667.

D) $76,667.

Correct Answer:

Verified

Q36: An investee company can be designated as

Q37: A Canadian controlled private corporation's GRIP balance

Q38: A corporation's dividend refund for the year

Q39: The refundable portion of a corporation's Part

Q40: Integration works when the combined federal and

Q42: Premier Investments Inc. (Premier)is a private corporation.

Q43: During the year, Makisha Fashions Inc has

Q44: The refundable Part IV tax on dividends

Q45: With respect to GRIP and LRIP balances,

Q46: With respect to Part I refundable taxes,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents