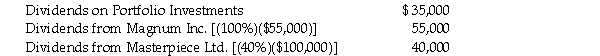

Opus Limited is a Canadian controlled private corporation. During 2020, the company received the following dividends:  Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Determine the amount of Part IV Tax payable by Opus Limited for the current year.

Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Determine the amount of Part IV Tax payable by Opus Limited for the current year.

A) $29,417.

B) $32,417.

C) $38,417.

D) $49,833.

Correct Answer:

Verified

Q55: CCPC Inc., a Canadian controlled private corporation,

Q56: As defined in ITA 129(4), aggregate investment

Q57: During the current year, Norton Tools Ltd.

Q58: Which of the following statements best describes

Q59: Which of the following items would NOT

Q61: With respect to GRIP and LRIP balances,

Q62: Marion Fox has investments that generate interest

Q63: At the end of 2019, Gomez Inc.,

Q64: Starfare Ltd. is a Canadian controlled private

Q65: Elm Inc. is a Canadian controlled private

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents