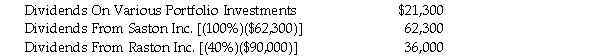

Overton Ltd. is a Canadian controlled private corporation. During 2020, the Company received the following amounts of dividends:  Overton Ltd. owns 100 percent of the voting shares of Saston Inc. and 40 percent of the voting shares of Raston Inc. The fair market value of the Raston Inc. shares equals 40 percent of the fair market value of all Raston Inc. shares. As a result of paying the $90,000 dividend, Raston Inc. received a dividend refund of $25,000. Saston Inc. received no dividend refund for its dividend payment.

Overton Ltd. owns 100 percent of the voting shares of Saston Inc. and 40 percent of the voting shares of Raston Inc. The fair market value of the Raston Inc. shares equals 40 percent of the fair market value of all Raston Inc. shares. As a result of paying the $90,000 dividend, Raston Inc. received a dividend refund of $25,000. Saston Inc. received no dividend refund for its dividend payment.

Determine the amount of Part IV Tax Payable by Overton Ltd. as a result of receiving these dividends.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: Patrick Innes has a business that he

Q70: Blackwood Inc. is a Canadian controlled private

Q71: For each of the key terms listed,

Q72: Simard Ltd., a CCPC, had no GRIP

Q73: A non-CCPC has an LRIP balance of

Q74: Janice Huber has a business that she

Q75: Florence has a business that she estimates

Q76: For each of the key terms listed,

Q78: Mr. Marcus Fisher has investments that generate

Q79: Nashwa has a business that she estimates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents