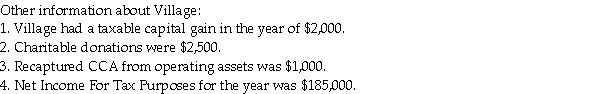

Village Concrete Inc. (Village) is a Canadian controlled private corporation (CCPC) with a year end of December 31, 2020. The owner of Village also controls Bob's Roofing Inc. (Bob's) , another CCPC with active business income for the year ended December 31, 2020 of $116,500. The owner has agreed to allocate a sufficient amount of the small business deduction to Bob's to ensure that all of its active business income is taxed at the lower rate. Other than the income related items listed below, you may assume that Village's income is from active business in Canada.  What is the appropriate small business deduction for Village?

What is the appropriate small business deduction for Village?

A) $34,770.

B) $34,675.

C) $35,150.

D) $72,865.

Correct Answer:

Verified

Q43: DDD Ltd. is a private corporation with

Q44: Which of the following statements with respect

Q45: Which of the following is an example

Q46: For 2020, Fosfo Inc., a Canadian controlled

Q47: With respect to determining provincial tax payable

Q49: Samson and Delilah are high fashion hair

Q50: A CCPC has Taxable Capital Employed in

Q51: Which of the following statements with respect

Q52: Grande Ltd. is a Canadian controlled private

Q53: Which of the following statements is correct?

A)Public

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents