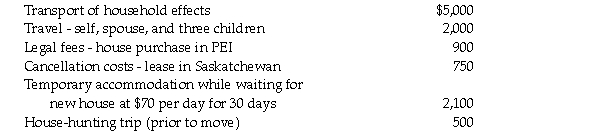

In 2020, Mr. Kumar moved from Saskatchewan to Prince Edward Island to start a new business. In his 2020 fiscal year, the business generated income in excess of $50,000. Mr. Kumar incurred the following costs of moving:  Which one of the following amounts represents the maximum amount that Mr. Kumar may deduct for moving expenses in his 2020 personal income tax return?

Which one of the following amounts represents the maximum amount that Mr. Kumar may deduct for moving expenses in his 2020 personal income tax return?

A) $ 8,800.

B) $ 9,700.

C) $10,200.

D) $11,250.

Correct Answer:

Verified

Q55: A father gives $10,000 in securities to

Q56: Which of the following statements related to

Q57: Which of the following statements with respect

Q58: At her death on August 1 of

Q59: Which of the following statements with respect

Q61: There are a number of benefits and

Q62: With respect to Tax Free Savings Accounts

Q63: Mr. Dayani purchases an annuity with funds

Q64: Charam and Baka each have income of

Q65: Which of the following statements with respect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents