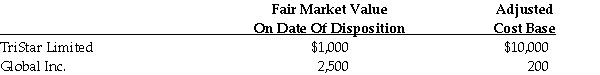

William Choring owned shares of two publicly traded companies, as follows:  William gifted the TriStar Limited shares to his wife on July 1, 2020. His wife kept the shares and received $138 of taxable dividends (grossed up amount) in September, 2020. William sold the Global Inc. shares on the open market. Assuming William earned no other income, did not elect out of ITA 73(1) , and these are the only transactions that occurred in the year, which one of the following represents William's 2020 Net Income For Tax Purposes?

William gifted the TriStar Limited shares to his wife on July 1, 2020. His wife kept the shares and received $138 of taxable dividends (grossed up amount) in September, 2020. William sold the Global Inc. shares on the open market. Assuming William earned no other income, did not elect out of ITA 73(1) , and these are the only transactions that occurred in the year, which one of the following represents William's 2020 Net Income For Tax Purposes?

A) Nil.

B) $1,150.

C) $1,250.

D) $1,288.

Correct Answer:

Verified

Q84: The questions below are based on the

Q85: Hugo owns a farm. Both Hugo and

Q86: Which of the following statements regarding the

Q87: When Alyssa Weinstein died, she left her

Q88: Erica Ho dies, leaving a depreciable property

Q90: John Bartel owns land with an adjusted

Q91: Martin has a marginal tax rate of

Q92: The questions below are based on the

Q93: John Bartel owns land with an adjusted

Q94: With respect to non-arm's length transfers of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents