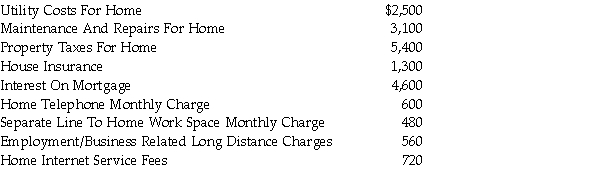

During the current year, Jonathan Beasley has the following costs:  Mr. Beasley estimates that he uses 18 percent of his residence and 30 percent of his home internet service for employment/business related purposes. Maximum CCA on 100 percent of the house would be $12,000. Determine the maximum deduction that would be available to Mr. Beasley assuming:

Mr. Beasley estimates that he uses 18 percent of his residence and 30 percent of his home internet service for employment/business related purposes. Maximum CCA on 100 percent of the house would be $12,000. Determine the maximum deduction that would be available to Mr. Beasley assuming:

A. He is an employee with $72,000 in income (no commissions).

B. He is an employee with $72,000 in commission income.

C. He is self-employed and earns $72,000 in business income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: During the current year, Janice Teason has

Q87: Mr. Alex Roddle acquires an automobile to

Q88: Bob's Hats is an unincorporated business. During

Q89: Mr. Jonathan Volke is a lawyer with

Q90: On August 1, 2020, Mr. Jimmy Bond

Q92: On February 28, 2019, a new Canadian

Q93: Frank's Auto Body, an unincorporated business, keeps

Q94: In January, 2020, Marty's Fine Pens sells

Q95: On January 1, 2019, a new Canadian

Q96: During 2020, Leslie's Boutique wrote off $13,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents