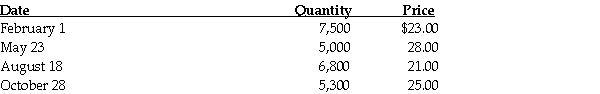

Morton Enterprises sells a single product which it buys from various manufacturers. It has a December 31 fiscal year end. During 2020, its first year of operations, purchases of this item were as follows:  On December 31, 2020, 7,800 of these items are still on hand. Their replacement cost on this date is $24.00 and they are being sold for $31.00. It is estimated that selling costs average 20 percent of the sales price. It is not possible to identify the individual items being sold. Calculate all the values that could be used for the 7,800 remaining units for tax purposes, identifying the method you used for each value.

On December 31, 2020, 7,800 of these items are still on hand. Their replacement cost on this date is $24.00 and they are being sold for $31.00. It is estimated that selling costs average 20 percent of the sales price. It is not possible to identify the individual items being sold. Calculate all the values that could be used for the 7,800 remaining units for tax purposes, identifying the method you used for each value.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: Frank's Auto Body, an unincorporated business, keeps

Q94: In January, 2020, Marty's Fine Pens sells

Q95: On January 1, 2019, a new Canadian

Q96: During 2020, Leslie's Boutique wrote off $13,000

Q97: Ms. Joan Vickers is an accountant and,

Q98: Mr. Brian Brock is selling his unincorporated

Q100: For a number of years, Ms. Alexandria

Q101: Coretta Kirkman is the sole proprietor of

Q102: In order to supplement his income working

Q103: Ms. Brooke Besson is selling her unincorporated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents