Use the following information to answer the questions below.

The Nelson Company has a taxation year end of December 31. On January 1 of the current year, the UCC of Class 8 was $80,000. The Nelson Company has a policy of always deducting maximum CCA. Each of the following questions deals with transactions during the current year which involved Class 8 assets. Choose the best answer for each question.

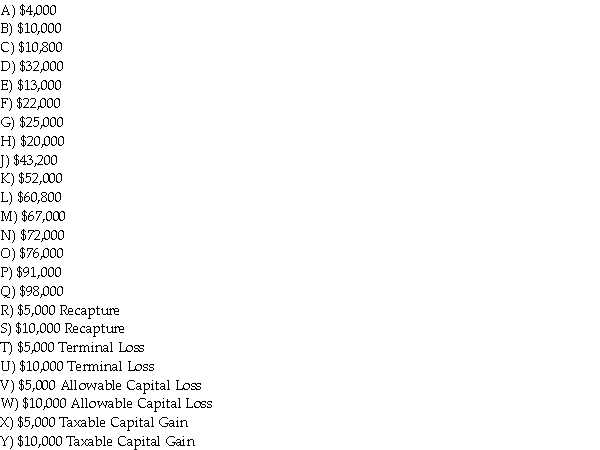

-An asset with a capital cost of $100,000 was sold on June 30 for $90,000. Also during the year, an asset was purchased for $60,000. Maximum CCA for Class 8 is:

Correct Answer:

Verified

Q25: An asset with a capital cost of

Q26: Use the following information to answer the

Q27: The last asset in the class, with

Q28: A business has Net Income For Tax

Q29: Of the following pairs of terms, which

Q31: Recapture of CCA occurs when there is

Q32: An asset with a capital cost of

Q33: Use the following information to answer the

Q34: The last asset in the class, with

Q35: Use the following information to answer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents