The following information relates to Andorn Ltd. for its taxation year that ends on December 31, 2020:

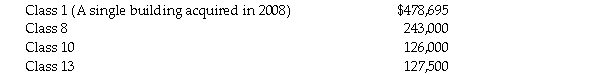

1. The Company has UCC balances on January 1, 2020 for its tangible assets as follows:  2. During 2020, the building that was acquired in 2008 was sold for cash of $650,000. Of this total, $125,000 represented the value of the land on which the building was situated. The building had a capital cost of $625,000, of which $80,000 represented the value of the land at time the building was acquired.

2. During 2020, the building that was acquired in 2008 was sold for cash of $650,000. Of this total, $125,000 represented the value of the land on which the building was situated. The building had a capital cost of $625,000, of which $80,000 represented the value of the land at time the building was acquired.

The building was replaced during 2020 with a new building at a cost of $745,000, of which $125,000 represented the value of the land.

The old building was used 100 percent for office space and was allocated to a separate Class 1. The new replacement building is also used 100 percent for office space and is allocated to a separate Class 1.

3. During 2020, the Company purchased office furnishings for $74,000. They traded in older furnishings and received an allowance of $17,000. The capital cost of the furnishings that were traded in was $56,000.

4. The only vehicle purchased during 2020 was a Lexus to be used by the president of the Company. The cost of this car was $93,000. The president drives it 23,000 kilometers during the year, of which 5,750 kilometers are for employment related purposes.

5. Andorn conducts some of its business out of a building which it leases. The lease was signed on January 1, 2018 and had an initial term of 7 years. It has an option to renew for 3 years. At the time the lease was signed, Andorn spent $150,000 on leasehold improvements.

6. During 2016, acquired a limited life franchise for $62,000. It has a legally limited life of 8 years.

7. Andorn Ltd. has deducted the maximum CCA in each year of operation.

Required: Calculate the maximum CCA write-off that can be deducted for 2020. Your answer should include the maximum that can be deducted for each CCA class. In addition, indicate the amount of any recapture or terminal loss that results from dispositions during 2020.

Correct Answer:

Verified

Q82: Fromor is a Canadian public company with

Q83: During 2020, Brondor Ltd. acquires two businesses.

Q84: Garick Ltd. has a December 31 year

Q85: At the beginning of 2020, Quest Inc.

Q86: Multilink Inc. has a December 31 year

Q88: For its taxation year ending December 31,

Q89: The following information relates to the Fortin

Q90: Votex Inc. closes its books on December

Q91: Farine Ltd. has a taxation year which

Q92: Shawarma Palace Ltd. was incorporated on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents