There are seven independent cases which follow. Each case involves various assumptions as to the amount and type of income earned by John Moss during 2020, as well as to other information that is relevant to the determination of his 2020 Tax Payable. John's Net Income For Tax Purposes is equal to his Taxable Income in all Cases.

In those cases where we have assumed that the income was from employment, the employer withheld the maximum EI premium and CPP contribution.

Case 1 - John is 58 years old and has employment income of $87,600. His common-law partner is 48 years old and has income of $8,260. They have an adopted child who is 19 years old and lives at home. John and his partner have medical expenses of $4,600. Medical expenses for the son total $10,300. The son has Net Income For Tax Purposes of $4,300.

Case 2 -John is 46 years old and has employment income of $160,000. His wife Mary is 41 years old and has Net Income For Tax Purposes of $6,100. They have a 20 year old son who lives at home. He is dependent because of a physical infirmity, but it is not severe enough to qualify him for the disability tax credit. However, he is able to attend university on a full time basis for 8 months during 2020. John pays his tuition fees of $9,400, as well as $720 for the textbooks that he requires in his program. The son has Net Income For Tax Purposes of $8,350. The son agrees to transfer the maximum of his tuition fee amount to John.

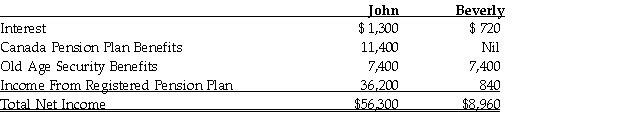

Case 3 -John and his wife Beverly are both 67 years of age. Beverly is sufficiently disabled that she qualifies for the disability tax credit. The components of income earned by John and Beverly are as follows:  Case 4 -John is 45 years old and has employment income of $97,100. His wife Marcia is 37 years old and has Net Income For Tax Purposes of $8,600. They have no children. However, they provide in home care for Marcia's father who is 61 years old, dependent because of a physical infirmity, and has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Also living with them is John's 67 year old father and 63 year old mother. They are both in good physical and mental health. John's father has Net Income For Tax Purposes of $23,200 and his mother has Net Income For Tax Purposes of $11,700.

Case 4 -John is 45 years old and has employment income of $97,100. His wife Marcia is 37 years old and has Net Income For Tax Purposes of $8,600. They have no children. However, they provide in home care for Marcia's father who is 61 years old, dependent because of a physical infirmity, and has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Also living with them is John's 67 year old father and 63 year old mother. They are both in good physical and mental health. John's father has Net Income For Tax Purposes of $23,200 and his mother has Net Income For Tax Purposes of $11,700.

Case 5 -John is 31 years old, has employment income of $83,000, and makes contributions of $3,000 to registered charities. He is not married and has no dependants.

Case 6 -John is 58 years old and has net rental income of $114,000. He is divorced and has been awarded custody of his 21 year old disabled son. The son qualifies for the disability tax credit and has Net Income For Tax Purposes of $8,430. He is dependent on his father for support.

Case 7 -John is 43 years old and has net rental income of $97,300. His wife died last year and he is a single parent of two children. Mack is 16 and is physically infirm, but does not qualify for the disability tax credit. He has income from part time work as a student counselor of $4,800. His daughter, Serena, is 10 and is in good health.

Required: In each Case, calculate the minimum 2020 federal Tax Payable for John Moss. Indicate any carry forwards available to him and his dependants and the carry forward provisions. Ignore any amounts John might have had withheld for taxes or paid in tax instalments and the possibility of pension splitting.

Correct Answer:

Verified

The solution for this Case is as ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: During the first 6 months of 2020,

Q89: Saul Lawson has a spouse, a 20

Q90: Leon Fiero has 2020 Net Income For

Q91: Betty Masters has 2020 Taxable Income of

Q92: Mr. Samuel Silverstein has a spouse and

Q94: John Trask is 67 years old and

Q95: For 2020, Mr. Oliver Clemens has net

Q96: Agnes is 66 years old. During 2020,

Q97: Lorraine tamer lives with her husband and

Q98: Mr. Allen Dion contributes $826 to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents