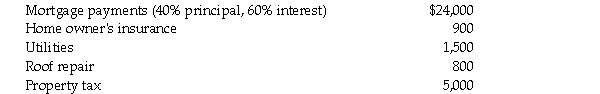

Nancy is employed by a large corporation as a sales representative. She is paid a salary of $70,000 during 2020. She is required to have a home office and uses the 375 square foot den in her 1,500 square foot house exclusively for this purpose. Total costs for 2020 were as follows:  As Nancy's compensation does not include any commissions, she is unable to use some of these costs as tax deductions. If instead, her compensation of $70,000 was in the form of commissions, she would be able to claim extra tax deductions of:

As Nancy's compensation does not include any commissions, she is unable to use some of these costs as tax deductions. If instead, her compensation of $70,000 was in the form of commissions, she would be able to claim extra tax deductions of:

A) $1,675.

B) $3,600.

C) $5,075.

D) $1,475.

Correct Answer:

Verified

Q63: Mr. Rudy Jackson is required by his

Q64: Mr. John Lamarche, as the result of

Q65: Which of the following statements about expense

Q66: Ms. Rhonda Jewel's employer provides her with

Q67: John Tertiak's employer sponsors a group disability

Q69: John secured employment as a commissioned salesman

Q70: Ms. Robin Nestor is provided with an

Q71: The questions below are based on the

Q72: Connely Ltd. has an August 31 year

Q73: Which of the following criteria is NOT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents