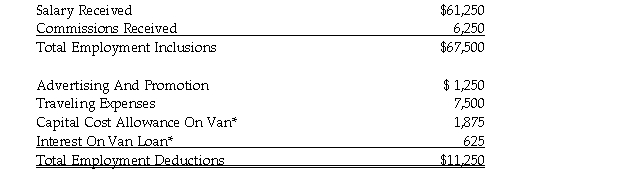

Doug Evans works for a company that sells video equipment. His records for the current year contain the following information:  *The van is used exclusively for employment related activities.

*The van is used exclusively for employment related activities.

Mr. Evans meets the conditions for deducting employment income expenses. Given the preceding information, determine Mr. Evans' minimum net employment income for the current year. Explain your conclusions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Each of the following independent Cases involves

Q89: Ms. Sharon Herzog works for a large,

Q90: Klaxton Inc. provides an automobile to Ms.

Q91: Joan Smithers has been employed by a

Q92: Jerry Farrow is employed by a Canadian

Q94: On May 1, 2020, Ms. Ponti receives

Q95: Ms. Mary Mason is employed by a

Q96: Fred Ethridge is a valued employee of

Q97: A senior executive asks her employer for

Q98: John Baxter is a highly valued employee

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents