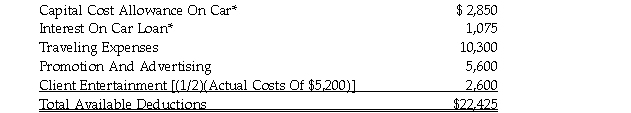

Deborah Ekert is employed as a salesperson and receives some of her compensation in the form of commissions. During the current year, her salary totaled $85,000 and her commissions totaled $8,400. Her employment related expenses during this period were as follows:  *The car is used exclusively for employment related activities.

*The car is used exclusively for employment related activities.

Ms. Ekert meets the conditions for deducting employment income expenses. Given the preceding information, determine Ms. Ekart's minimum net employment income for the current year. Explain your conclusions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Mr. Robert Rhodes is provided with an

Q79: The questions below are based on the

Q80: Brock Inc. has a taxation year that

Q81: Mrs. Joan Conway is a commission salesperson.

Q82: Several years ago, Mr. Kerry Johnson's employer

Q84: Jerry Field was hired by Larson Wholesalers

Q85: Barton Ho is a commission salesperson. During

Q86: Mr. John Savage has been employed for

Q87: Ms. Mary Mason is employed by a

Q88: Each of the following independent Cases involves

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents