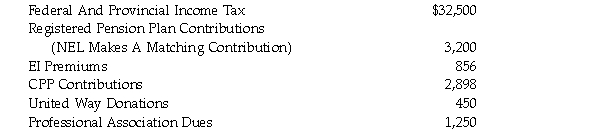

On January 2, 2020, Ms. Shirley Kantor moves from London, Ontario, to Thunder Bay, Ontario, in order to begin employment with Northern Enterprises Ltd. (NEL). Her salary for the year was $142,000. NEL withheld the following amounts from her earnings:  Other Information:

Other Information:

1. Shirley's moving expenses total $6,800. NEL reimbursed Shirley for 100 percent of these costs.

2. For the year ending December 31, 2020, Shirley was awarded a bonus of $32,000. Of this total, $25,000 was paid during 2020, with the remainder payable in January, 2021.

3. NEL provided Shirley with a car to be used in her employment activities and paid the operating costs for the year that totalled $8,100. The cost of the car was $39,550, including HST of $4,550. The car was available to Shirley throughout 2020. She drove a total of 63,000 kilometers. This included 8,000 kilometers of personal use.

4. In negotiating her new position with NEL, Shirley had asked for a $50,000 interest free loan as one of her benefits. NEL's human resources department indicated that the CEO would not approve any employee loans. However, they agreed to advance $50,000 of her 2021 salary as of November 1, 2020.

5. In her employment related travels, Shirley has accumulated over 100,000 Aeroplan points. During 2020, she and her partner Diane used 50,000 of these points for a weekend flight to New York City. If she had purchased them, the tickets would have cost a total of $940.

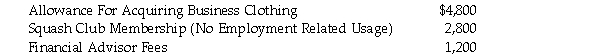

6. NEL provided Shirley with the following additional benefits:  7. Shirley's previous employer was a Canadian controlled private corporation. In 2019, she was granted options to buy 500 of the company's shares at $20 per share. This option price was higher than the estimated fair market value of the company's shares at the time the options were granted. On January 2, 2020, Shirley exercised these options. At this time the fair market value of the shares was $28 per share. Shirley immediately sells the shares for $28 per share.

7. Shirley's previous employer was a Canadian controlled private corporation. In 2019, she was granted options to buy 500 of the company's shares at $20 per share. This option price was higher than the estimated fair market value of the company's shares at the time the options were granted. On January 2, 2020, Shirley exercised these options. At this time the fair market value of the shares was $28 per share. Shirley immediately sells the shares for $28 per share.

8. Shirley was required by her employer to acquire a laptop computer to be used in her employment duties. At the beginning of 2020, she purchased a computer at a cost of $1,356, including HST of $256. During 2020, her expenditures for computer related supplies totalled $150.

Required: Determine Shirley's net employment income for the year ending December 31, 2020.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: John Baxter is a highly valued employee

Q99: Mr. John Savage has been employed for

Q100: On January 1, 2020, Mr. Packard receives

Q101: During January, 2018, Lastech Inc. issued options

Q102: Albert Lee is an employee of a

Q103: Olin Packett has been employed for over

Q105: Ms. Martha Gobel is a linguist, specializing

Q106: Alicia Arden has established herself as a

Q107: Ms. Matilda Bracken is a Certified Financial

Q108: Opting Inc. has a very generous stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents