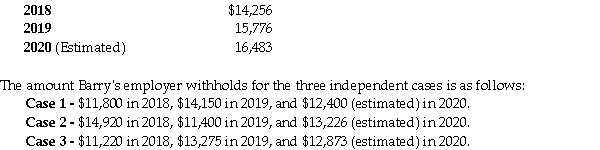

In the three independent cases which follow, assume that Barry Levenor's combined federal and provincial Tax Payable is as follows:  Required:

Required:

A. For each of the three cases:

• indicate whether instalments are required for the 2020 taxation year;

• in those Cases where instalments are required, calculate the amount of the instalments that would be required under each of the three acceptable methods; and

• in those cases where instalments are required, indicate which of the three acceptable methods would be the best alternative.

B. For those Cases where instalments are required, indicate the dates on which the payments will be due.

Correct Answer:

Verified

Barry's net tax owing in...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Nancy Forth filed her 2020 tax return

Q83: Mr. James Simon has asked for your

Q84: For the taxation year ending December 31,

Q85: For each of the following independent cases,

Q86: The taxation year end for Breyson Ltd.

Q87: For the three years ending December 31,

Q88: For both tax and accounting purposes Ledux

Q89: For the three years ending December 31,

Q91: For 2018, Mr. Mason Boardman has combined

Q92: For the three years ending December 31,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents