The following two Cases make different assumptions with respect to the amounts of income and deductions that are available to Carl Suzak, a Canadian resident, for the current year.

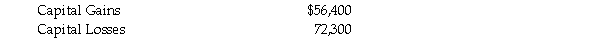

Case A - Carl had employment income of $126,100, as well as income from an unincorporated business of $14,100. A rental property owned by Carl experienced a net loss of $4,600. Dispositions of capital property during the current year had the following results:  In compliance with the terms of his divorce agreement, Carl paid deductible spousal support of $600 per month for the entire year. In addition to the preceding items, Carl had a winning lottery ticket which resulted in his receiving a prize of $562,000.

In compliance with the terms of his divorce agreement, Carl paid deductible spousal support of $600 per month for the entire year. In addition to the preceding items, Carl had a winning lottery ticket which resulted in his receiving a prize of $562,000.

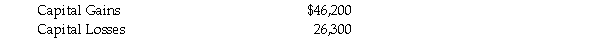

Case B - Carl had employment income of $89,000, interest income of $3,100, and net rental income of $8,600. Carl also operated an unincorporated business. Unfortunately, during the current year, it experienced a net loss of $187,400. Dispositions of capital property during the current year had the following results:  Also during the current year, Carl made deductible contributions of $8,600 to his RRSP.

Also during the current year, Carl made deductible contributions of $8,600 to his RRSP.

Required: For each Case, calculate Carl's Net Income For Tax Purposes (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the current year.

Correct Answer:

Verified

The Case A solution would be calc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: Mrs. Janice Theil gives $50,000 in Canada

Q135: Mr. Valone is a U.S. citizen. However,

Q136: Ms. Sonia Nexus is a computer specialist

Q137: Indicate which of the corporations described in

Q138: Ms. Sharon Washton was born 26 years

Q139: Wolfhowl Ltd. was incorporated in Banff, Alberta

Q140: For each of the following persons, indicate

Q141: The following two Cases make different assumptions

Q143: Karla Gomez is a Canadian resident who

Q144: The following four Cases make different assumptions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents