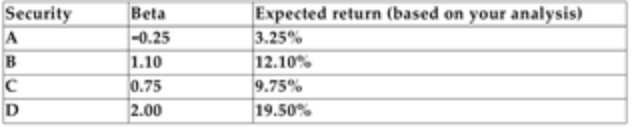

You have analyzed the following four securities and have estimated each security's beta and what you expect each security to return next year. The expected return on the market portfolio is 12%, and the relevant risk-free rate is 5%.

-Refer to the information above. Based on your analysis, which of the securities is (are) overpriced?

A) Security A only

B) Security B and Security D

C) Security B and Security C

D) Security D only

Correct Answer:

Verified

Q13: You have $5,000 invested in Security M,

Q14: You have analyzed the following four securities

Q15: You have analyzed the following four securities

Q16: The expected return on the market portfolio

Q17: Which of the following is not one

Q19: Security A is expected to return 12%

Q20: In the CAPM world, investors measure the

Q21: A zero-coupon bond has a beta of

Q22: When evaluating a project, the chance of

Q23: The Security Market Line depicts the relationship

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents