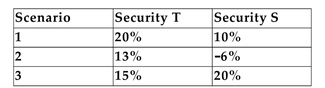

The following returns have been estimated for Security T and Security S:  Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

-Refer to the information above. What is the standard deviation of the rate of return of the portfolio? Round your answer to the nearest tenth of a percent.

A) 0.0%

B) 19.9%

C) 4.5%

D) 59.7%

Correct Answer:

Verified

Q10: An investor invests $4,000 to buy 200

Q11: An investor decides to split his money

Q12: The following equally likely outcomes have been

Q13: A mutual fund has five equally likely

Q14: The following equally likely outcomes have been

Q16: The following equally likely outcomes have been

Q17: The following returns have been estimated for

Q18: Which of the following is (are)a measure(s)of

Q19: The following equally likely outcomes have been

Q20: A mutual fund has five equally likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents