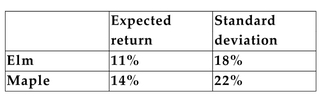

You have collected the following information for the returns of the Elm Corporation and the Maple Corporation:  The covariance of the returns of the two securities is 277.2%%.

The covariance of the returns of the two securities is 277.2%%.

-Refer to the information above. If you invest 40% of your money in Elm and 60% in Maple, what is the standard deviation of the returns on your portfolio?

A) 18.95%

B) 8.16%

C) 23.52%

D) none of the above

Correct Answer:

Verified

Q50: The Canton Corporation consists of three divisions:

Q51: You have divided your money equally between

Q52: You have invested in a portfolio of

Q53: Which of the following best defines the

Q54: Write the general formula for the variance

Q55: Use a spreadsheet to calculate the variances

Q57: You have $5,000 cash to invest and

Q58: You have $5,000 cash to invest and

Q59: The Canton Corporation consists of three divisions:

Q60: Your firm uses 50% debt financing and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents