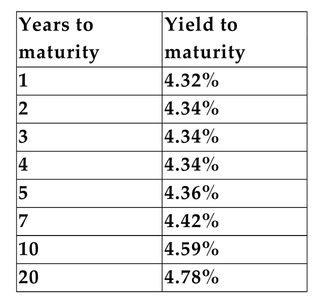

Assume that the following data on U.S. Treasury securities is current:

-Refer to the information above. You purchase a $1,000, zero-coupon, Treasury bond that matures in seven years. Assume the term structure remains constant and that your sell the

Bond after having held it only 5 years. At what price should you be able to sell it?

A) $1,237.86

B) $914.50

C) $807.85

D) $958.22

Correct Answer:

Verified

Q46: True, false, or uncertain: Longer-term projects have

Q47: An upward sloping yield curve means that

A)long-term

Q48: Assume that the following data on U.S.

Q49: The following yields were reported for Treasury

Q50: Assume that the following data on U.S.

Q52: Assume that the following data on U.S.

Q53: The following yields were reported for Treasury

Q54: Assume that the following data on U.S.

Q55: Assume that the following data on U.S.

Q56: A 1-year bond is yielding 7.4%, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents