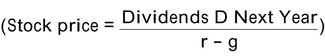

The Gordon growth model  assumes that

assumes that

A) dividends will grow at the constant rate of r forever.

B) dividends will grow at the constant rate of g forever.

C) dividends will remain at their current level indefinitely.

D) dividends will remain at next year's level indefinitely.

Correct Answer:

Verified

Q1: A financial advisor says she has an

Q3: A project is expected to produce a

Q4: All else equal, the price of a

Q5: You would like to establish a fund

Q6: What is the maximum you should be

Q7: Which of the following inputs is not

Q8: An issue of preferred stock that pays

Q9: Decline, Inc. currently produces cash flows of

Q10: The Sentinel Corporation has an issue of

Q11: In May 2008, the Yahoo!Finance website provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents