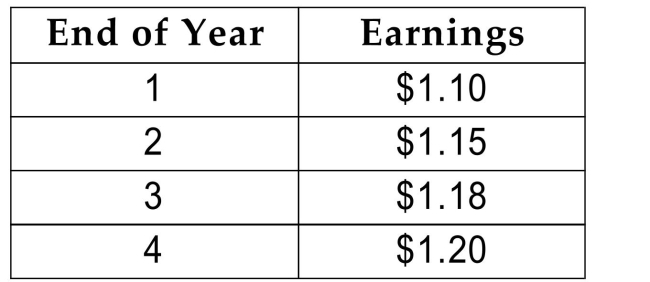

The earnings per share of Erratic Corporation are projected to be as follows:  After year 4, earnings are expected to grow at a constant rate of 6% indefinitely. If the required rate of return is 12%, what would you estimate the value of Erratic's stock to be? Round your

After year 4, earnings are expected to grow at a constant rate of 6% indefinitely. If the required rate of return is 12%, what would you estimate the value of Erratic's stock to be? Round your

Answer to the nearest dollar.

A) $16

B) $13

C) $17

D) $12

Correct Answer:

Verified

Q33: Freedom Enterprises is considering investing in a

Q34: Jason wishes to be able to receive

Q35: If you accumulate $800,000 in your retirement

Q36: Joe Cool plans to hit the campus

Q37: A certain stock paid a dividend of

Q39: If the effective annual yield on a

Q40: An issue of preferred stock pays an

Q41: Assume the prevailing interest rate is 8%

Q42: When your firm hires a new employee

Q43: A University of Colorado revenue bond pays

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents