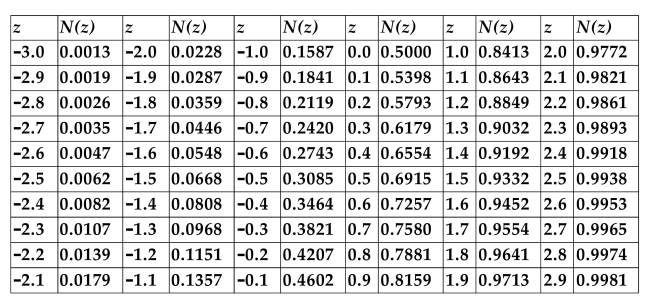

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. Calculate the value of a call option on a stock that is

currently selling for $88 if the strike price is $90, the option expires in 3 months, the

implied volatility of the underlying stock returns is 22%, and the annualized risk-free

rate is 4%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: You bought a call option with a

Q20: One option contract is typically an option

Q21: Assume an investor buys a call option

Q22: Explain how you could duplicate a short

Q23: An investor can create a synthetic call

Q25: Under what two conditions might an American

Q26: You purchase both a call option and

Q27: An investor can duplicate the payoffs generated

Q28: The volatility smile

A)suggests that the prices for

Q29: If there is to be no arbitrage

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents