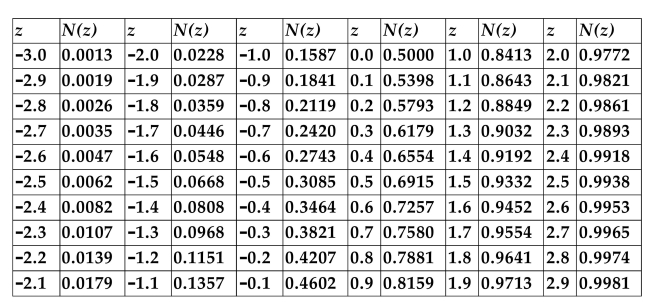

CUMULATIVE NORMAL DISTRIBUTION TABLE

-Refer to the information above. A stock is currently selling for $60. The stock pays no dividends. A call option on the stock has a strike price of $55 and has 3 months to expiration.

The implied volatility is 30%, and the annualized risk-free rate is 3%. What is the option's

Hedge ratio, rounded to the nearest hundredth?

A) 0.55

B) 0.71

C) 0.76

D) 0.70

Correct Answer:

Verified

Q39: A European put option on a certain

Q40: A call option with 6 months to

Q41: Inmar Corporation is a mail-order company that

Q42: The change in the price of the

Q43: The price of a call option will

Q45: If the hedge ratio for a call

Q46: In which of the following corporate applications

Q47: Indicate how the indicated change in each

Q48: All else equal, what effect will an

Q49: Assume that a stock is currently selling

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents