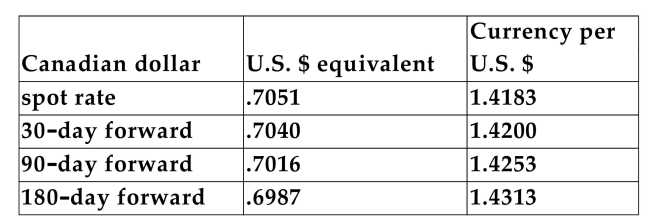

The following exchange rates existed between the U.S. dollar and the Canadian dollar at a given point in time:

-If an American firm expects to receive payment in Canadian dollars 90 days from now and is concerned that the spot exchange rate in 90 days will be less than U.S. $0.7016, it should

A) agree to buy Canadian dollars forward at the exc

B) agree to deliver Canadian dollars 90 days from now in exchange for  by selling the Canadian dollars forward.

by selling the Canadian dollars forward.

C) agree to buy 1.4253 U.S. dollars 90 days from now in exchange for 0.7016 Canadian dollars.

D) agree to deliver 1.4253 U.S. dollars 90 days from now in exchange for 0.7016 Canadian dollars.

Correct Answer:

Verified

Q37: A U.S. firm has invested in a

Q38: A U.S. firm invested $800,000 in a

Q39: If a British investor and an American

Q40: A U.S. firm invested $1 million in

Q41: The agency that was established to encourage

Q43: Assume you are a manager of a

Q44: If a British firm issues a bond

Q45: If you are the manager of a

Q46: A Eurobond is

A)a general term for any

Q47: If a Canadian firm is expecting to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents