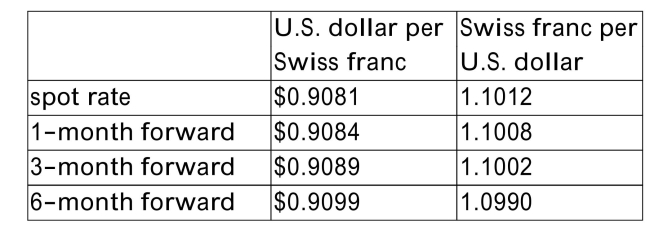

Your U.S. firm will need to make a payment of 200,000 Swiss francs in 6 months and

would like to hedge its exchange rate risk. The following data has been collected on

the Swiss franc/U.S. $ exchange rates:  Explain what your firm should do to hedge the risk completely. Be specific. What will

Explain what your firm should do to hedge the risk completely. Be specific. What will

be the dollar cash outflow to your firm in 6 months if it executes this hedge? What

would it be if the actual future spot rate were 1.0890 Swiss francs/$ in 6 months, and

your firm had not executed this hedge?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Assume you are a manager of a

Q44: If a British firm issues a bond

Q45: If you are the manager of a

Q46: A Eurobond is

A)a general term for any

Q47: If a Canadian firm is expecting to

Q49: A German firm is expecting to receive

Q50: Currency hedging can increase firm value

A)by increasing

Q51: If you are the manager of a

Q52: Empirical evidence suggests that

A)The returns of Real

Q53: The United Nations non-profit agency that both

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents