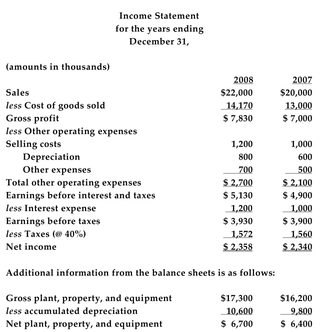

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

-Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. The cost of capital

Is 14%, and Infonext's 2009 cash flows are expected to remain at that level forever. Calculate

Infonext's terminal value at the end of 2009. Round your answer to the nearest thousand

Dollars.

A) $25,586

B) $29,720

C) $28,002

D) $25,900

Correct Answer:

Verified

Q50: One of the biggest problems with pro

Q51: A firm's cash flow this year was

Q52: A firm's cash flow this year was

Q53: One negative effect of using more debt

Q54: A firm's cash flow this year was

Q56: To determine the appropriate cost of capital

Q57: If you are negotiating the sale of

Q58: A firm has a project cash flow

Q59: You would want your firm to issue

Q60: A firm is projected to have a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents