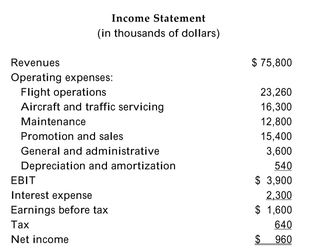

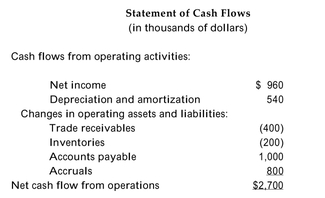

The pro forma income statement and cash flow statement for OneShot, Inc., are provided below. The firm has a cost of capital of 10%.

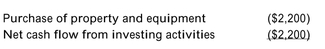

Cash flows from investing activities:

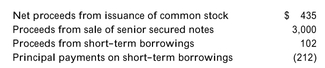

Cash flows from investing activities:  Cash flows from financing activities:

Cash flows from financing activities:

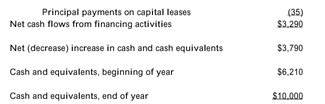

-Refer to the income statement and cash flow statement above. Assume that OneShot's project cash flows are a perpetuity, and calculate its NPV.

A) $28,000

B) $72,000

C) $5,000

D) $49,000

Correct Answer:

Verified

Q26: A firm is currently financed with $300

Q27: A firm's investments cost $5,000 today and

Q28: Your firm has a before-tax return of

Q29: Which of the following is the correct

Q30: A firm's investments cost $5,000 today and

Q32: A firm has expected before-tax earnings of

Q33: A 3-year project will cost $180 at

Q34: Assume that your firm's investments will earn

Q35: A 3-year project will cost $180 at

Q36: A firm is currently financed with $300

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents