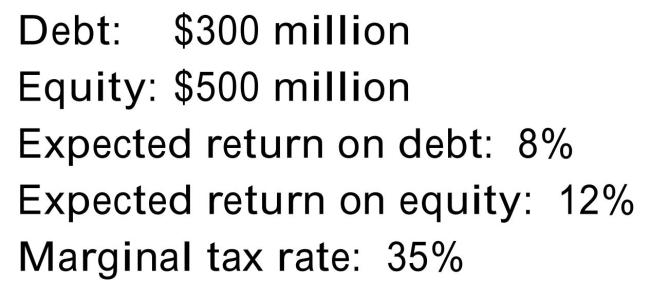

You have collected the following information for your firm:  Your firm is contemplating increasing its debt by $100 million and using the funds to repurchase $100 million in equity. The debt would be perpetual and would have a perpetual

Your firm is contemplating increasing its debt by $100 million and using the funds to repurchase $100 million in equity. The debt would be perpetual and would have a perpetual

Expected return of 8.5%. The firm's current marginal tax is also expected to be permanent.

What will this change do to the value of the firm?

A) It will decrease firm value by $20 million.

B) It will increase firm value by 35 million.

C) It will increase firm value by $140 million.

D) It will decrease firm value by about $12 million.

Correct Answer:

Verified

Q41: The pro forma income statements and excerpts

Q42: If Congress were to pass a law

Q43: Under which of the following circumstances might

Q44: The advantage of the adjusted present value

Q45: Assume a U.S. company is in a

Q47: The ForeverMore Corporation plans to issue $600,000

Q48: Which of the following statements is true

Q49: What two assumptions are made when calculating

Q50: Calculate the IRR of the firm.

Q51: The Feline Corporation has $50,000 debt with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents