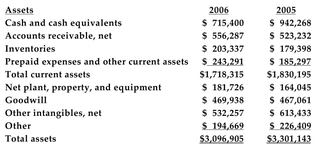

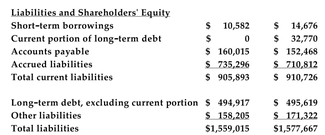

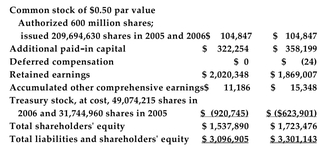

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars) :

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

-Refer to the information above. What was Hasbro's liabilities-to-assets ratio, based on the book value of the assets in 2006?

A) 17.9%

B) 55.3%

C) 50.3%

D) 29.3%

Correct Answer:

Verified

Q39: What are the advantages and disadvantages associated

Q40: Which of the following statements regarding preferred

Q41: Below are 2005 and 2006 balance sheets

Q42: The following information has been collected from

Q43: The following information has been collected from

Q45: Below are 2005 and 2006 balance sheets

Q46: Below are 2005 and 2006 balance sheets

Q47: Below are 2005 and 2006 balance sheets

Q48: Pensions and other unspecified liabilities accounted for

Q49: How much hybrid financing is Firm A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents