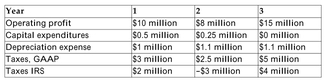

The following information is provided for a firm:  a. Calculate the amount of deferred taxes that the firm will report on its balance sheet

a. Calculate the amount of deferred taxes that the firm will report on its balance sheet

in years 2 and 3.

b. Calculate the real after-tax cash flows for the firm in years 2 and 3.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Which of the following is a correct

Q31: Which of the following is a correct

Q32: Which of the following transactions is most

Q33: The following information is provided for a

Q34: Which of the following is a correct

Q36: Given that depreciation is not an actual

Q37: The Trimark Corporation is considering replacing an

Q38: Assume your firm will consist of just

Q39: Deferred taxes are

A)taxes that need never be

Q40: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents