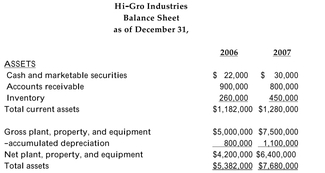

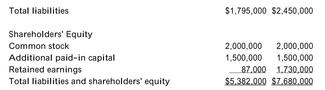

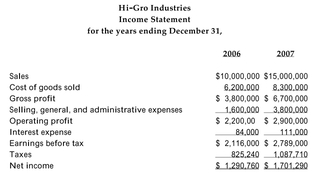

The 2006 and 2007 income statements and balance sheets for Hi-Gro Industries are provided below:

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

Assume that the difference in the gross plant, property, and equipment account reflects Hi-Gro's capital expenditures and that the change in its long-term debt account reflects its net issuance of debt. Assume, also, that the actual taxes paid in 2007 were $1,131,000.

-Refer to the information above. Calculate Hi-Gro's free cash flow to both debt and equity investors (i.e., the project cash flows) for 2007.

A) +$339,000

B) -$461,000

C) +$399,000

D) -$643,000

Correct Answer:

Verified

Q51: A firm's annual report contains the following

Q52: The Sinbad Corporation's 2007 annual report contained

Q53: All else equal, if a firm reduces

Q54: Which of the following might be a

Q55: When comparing two firms based on their

Q57: You are examining a firm's cash flow

Q58: Dividend payments to shareholders is a

A)cash flow

Q59: A firm reported $400,000 in net income

Q60: The Miners' Deli is considering the purchase

Q61: The 2007 financial statements for Freedom Air,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents