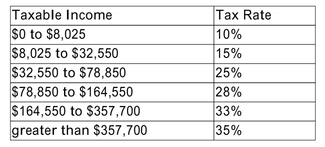

In 2008, the tax schedule for a single taxpayer is as follows:  What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

A) marginal rate = 28%; average rate = 15.0%

B) marginal rate = 25%; average rate = 18.9%

C) marginal rate = 28%; average rate = 32.5%

D) marginal rate = 25%; average rate = 13.7%.

Correct Answer:

Verified

Q16: Assume that you and your bank agree

Q17: Which of the following statements is true?

A)A

Q18: The "depth" of a market is defined

Q19: How perfect do you think the market

Q20: Explain the following statement: "Although everyone is

Q22: The Calico Corporation pays taxes at the

Q23: Is the market in which the utilities

Q24: Which is the correct statement regarding the

Q25: If a municipal bond returns 6% and

Q26: The bid price for Sun Microsystems (JAVA)is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents