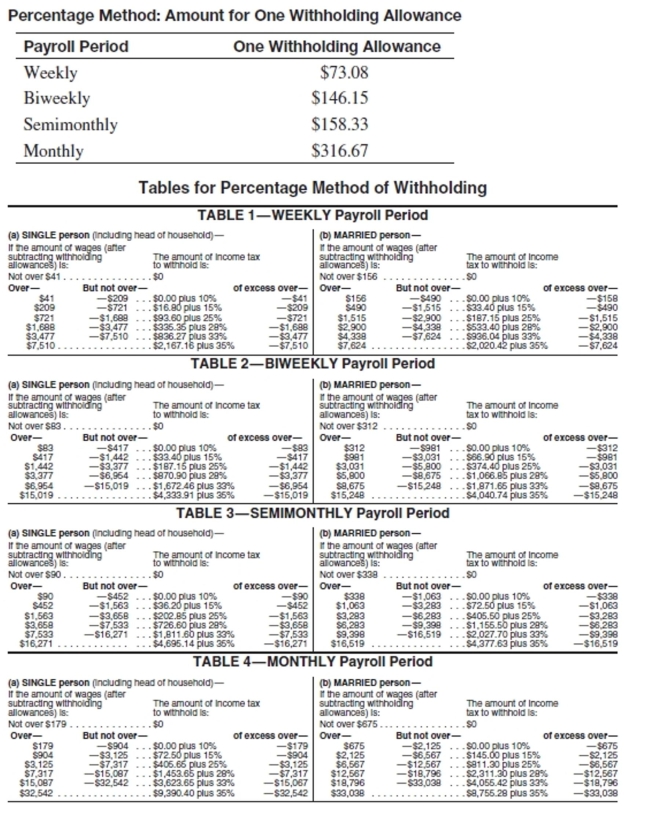

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

-Carla LaFong has gross earnings of $3576.57 weekly. She is married and has 2 withholding allowances.

A) $2,621.05

B) $3,302.96

C) $2,894.66

D) $3,984.87

Correct Answer:

Verified

Q13: Find the hours, rate, or earnings as

Q14: Find the equivalent earnings.

-Chuck earns $363 a

Q15: Find the gross earnings. Use the overtime

Q16: Find the hours, rate, or earnings as

Q17: Solve the problem.

-Bob works for Allies Electronics

Q19: Find the gross earnings for the employee.

-Westinghouse

Q20: Solve the problem.

-Allied Industries pays at the

Q21: Find the Social Security tax (6.2%), Medicare

Q22: Find the Social Security tax and Medicare

Q23: Find the gross earnings. Use the overtime

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents