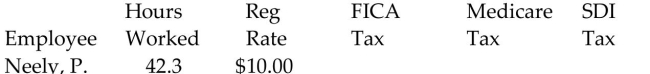

Find the Social Security tax (6.2%) , Medicare tax (1.45%) , and state disability insurance deduction (1%) for the employee.

Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that

time-and-a-half is paid for any overtime in a 40-hour week. Round to the nearest cent if needed.

-

A) $39.34, $9.20, $6.35

B) $26.94, $6.30, $4.35

C) $26.23, $6.13, $4.23

D) $24.80, $5.80, $4.00

Correct Answer:

Verified

Q34: Use the percentage method of withholding to

Q35: Find the gross earnings for the employee.

-Westinghouse

Q36: Solve the problem. Use a FICA rate

Q37: Solve the problem.

-Tom Darcy makes $4.75 for

Q38: Find the weekly gross earnings. Overtime is

Q40: Calculate the total amount due to the

Q41: Solve the problem. Use a FICA rate

Q42: Solve the problem.

-Find the gross earnings.

Q43: Solve the problem.

-Mike Penn is an employee

Q44: Calculate the total amount due to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents