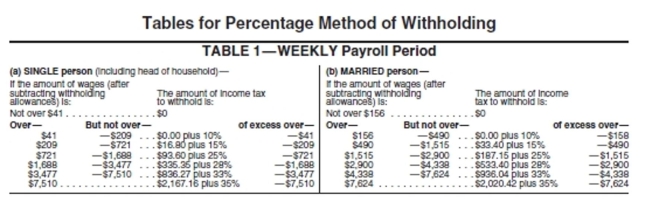

Use the percentage method of withholding, a FICA rate of 6.2%, a Medicare rate of 1.45%, an SDI rate of 1%, and a state

withholding tax of 3.4%. One withholding allowance is $73.08 when paid weekly.

-Charles Nave, bank teller, has weekly earnings of $610. He is married and claims 3 withholding allowances. His deductions include FICA, Medicare, federal withholding, state disability insurance,

State withholding, and credit union savings of $50. Find his net pay.

A) $513.21

B) $425.49

C) $463.21

D) $453.51

Correct Answer:

Verified

Q47: Find the weekly gross earnings. Overtime is

Q48: Solve the problem.

-Al's Recycling Center pays local

Q49: Use the percentage method of withholding, a

Q50: Find the weekly gross earnings. Overtime is

Q51: Find the Social Security tax and Medicare

Q53: Calculate the total amount due to the

Q54: Solve the problem.

-Suppose eggplant pickers are paid

Q55: Find the Social Security and Medicare taxes

Q56: Solve the problem.

-Stephen Rodrigues assembles and finishes

Q57: Solve the problem. Use a FICA rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents