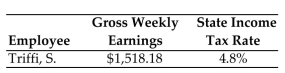

Use the state income tax rate given to find the state withholding tax for the following employee. Round to the nearest

cent.

-

A) $728.73

B) $7,287.26

C) $1.53

D) $72.87

Correct Answer:

Verified

Q93: Find the equivalent earnings.

-Kathy's yearly salary is

Q94: Solve the problem.

-Barbara is paid $10.88 per

Q95: Solve the problem.

-Kathy's regular hourly rate is

Q96: Find the Social Security tax and Medicare

Q97: Find the gross earnings for the employee.

-Westinghouse

Q99: Solve the problem.

-Arnold's regular hourly rate is

Q100: Solve the problem.

-Find the gross earnings. Units

Q101: Find the federal withholding tax for the

Q102: Find the Social Security and Medicare taxes

Q103: Solve the problem.

-Anita is paid $13.78 per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents